mAGa Dollar: Silver Cinderella

Trump’s MAGA Dollar Plan

Mr Trump has a MAGA plan to reduce the US trade deficit by weakening the US dollar — a lot.

The dollar is down over ten percent since its peak in January this year. The average US dollar bear market peak-to-trough decline since 1967 is 33%.Buckle UP!

MAGA dollar bears have been buying bitcoin and gold at record pace in the first half of 2025, with ~US$15 billion into bitcoin and ~US$21 billion into gold ETFs.

“Your groceries aren’t becoming more expensive; your money is becoming less valuable. Your supermarket is not the problem; your central bank is””

Cinderella Silver

Cinderella Silver is coming to the ball. Read on for Catt Calls’ new Silver Egg — the Fairy Godmother is just arriving at the gate and shall soon transform into a beautiful silver carriage to take Cinderella Silver to the Ball!

Cinderella Silver shall go to the ball

Here are the 20-year outstanding shares of the iShares Silver Trust SLV ETF. When people buy, the shares outstanding increase. The SLV ETF shares out are still ~25% below their 2021 high. Silver investment demand normally follows the silver price.

Silver investment demand normally follows price

America’s Silver Memory

The American people retain a collective memory of silver’s role as money and a store of wealth, rooted in its long historical use as currency.

The Coinage Act of 1792 established the bi-metallic scaffolding that founded the US Dollar at a ratio of 15:1 gold to silver.

Yours truly was one month and one day old when, on August 15th 1971, US President Nixon ended gold convertibility at $35 per ounce. Silver was then $1.54 per ounce — a gold to silver ratio of 23:1.

Gold and Silver Through the Ages

The role of gold and silver as US ‘money’ has changed over time:

A century of precedent shows how the gold-to-silver ratio blows out to over 100:1 in times of crisis and compresses to between 20 and 30 in times of monetary debasement, war and inflation.

Silver Today

The role of silver as a store of wealth for Americans is not an artefact of history.

The Silver Institute in their 2025 World Silver Survey notes that in the fifteen years until the end of 2024, Americans accumulated an astounding 1.5 billion ounces of physical silver.

Indians, known for their voracious appetite for precious metals, motivated by a forever depreciating rupee by comparison brought 840 million ounces of bars and coins over the decade to the end of 2024.

Australia is the surprising recent fourth-largest physical silver buyer — in 2019 Aussies bought 3.5 million ounces, increasing to 20.7 million ounces by 2024.

Four years of substantial silver deficits have consumed ~800 million ounces of above-ground silver inventory to feed record industrial demand. Never before in history has silver witnessed today’s record industrial demand allied with emergent investment demand.

A century of precious metal monetary history

A rerun of the 2011 silver bull market and compression of the gold-to-silver ratio from the current 87:1 to 30:1 implies a US$120 silver target using the current US$3,600/oz gold price (see Silver Slingshot).

The silver price today is just beginning its ascent in the great precious metals bull market of the 2020s. Gold and silver funds have just witnessed their fourth-largest inflow ever.

Bank Of America - Michael Hartnett

The Case for Silver Miners

Jonathan Goodman of Dundee Corporation said at last week’s Precious Metals Summit in Beaver Creek:

“We might have just seen the bottom in interest in gold shares.”

What About Our Silver Eggs?

Most precious metal miners produce more gold than silver by value. Coeur Mining and Hecla Mining, the oldest and best-known American silver “brands,” had attributed silver revenue of 34% and 44% respectively for the first half of 2025, with gold being the majority of their revenue.

I own both Coeur and Hecla mainly because they are the most familiar brand names American equity investors will swipe off the shelf first when they go shopping for silver.

Regular readers of Catt Calls have heard me previously describe my Silver Eggs: Coeur Mining, Discovery Silver and Mithril Silver & Gold.

Today, I am replacing Coeur Mining with a new Silver Egg — but first, a quick refresh on Discovery Silver and Mithril Silver & Gold.

Discovery Silver

Discovery Silver has the capability and desire to return the recently acquired Porcupine gold camp in Timmins, Canada, to Tier One Status with >500,000 ounces of annual gold production. Discovery Silver’s Canadian gold assets carry more than 90% of Discovery’s value.

Discovery’s Cordero Project in Mexico (watch video) is the world’s largest undeveloped silver reserve at over 300 million ounces.

I believe — unlike many — that Cordero will soon receive a permit from Mexico’s Sheinbaum administration and become the poster child for sustainable mineral development in Mexico. I wonder if the pending state visit of Canadian Prime Minister Mark Carney to Mexico, to meet President Sheinbaum, might provide an auspicious moment to announce the go ahead for Discovery Silver’s Cordero Mine — a project set to generate US$1.2 billion in inbound investment, create 2,500 jobs, and deliver US$2.5 billion in tax revenue for Mexico

Your correspondent overlooking Mexico’s next major silver mine - the Cordero Project

Mithril Silver & Gold

Mithril Silver & Gold is a Silver Egg because of its ultra high-grade gold and silver exploration potential at its Copalquin Project in Mexico. I think of Mithril as an early-stage Silvercrest — taken over by Coeur Mining in 2024 for US$1.7 billion. We await the imminent drill results from Mithril’s silver-rich Target 5 or Apomal property.

Underground at an old mine working at Mithril’s Copalquin Project

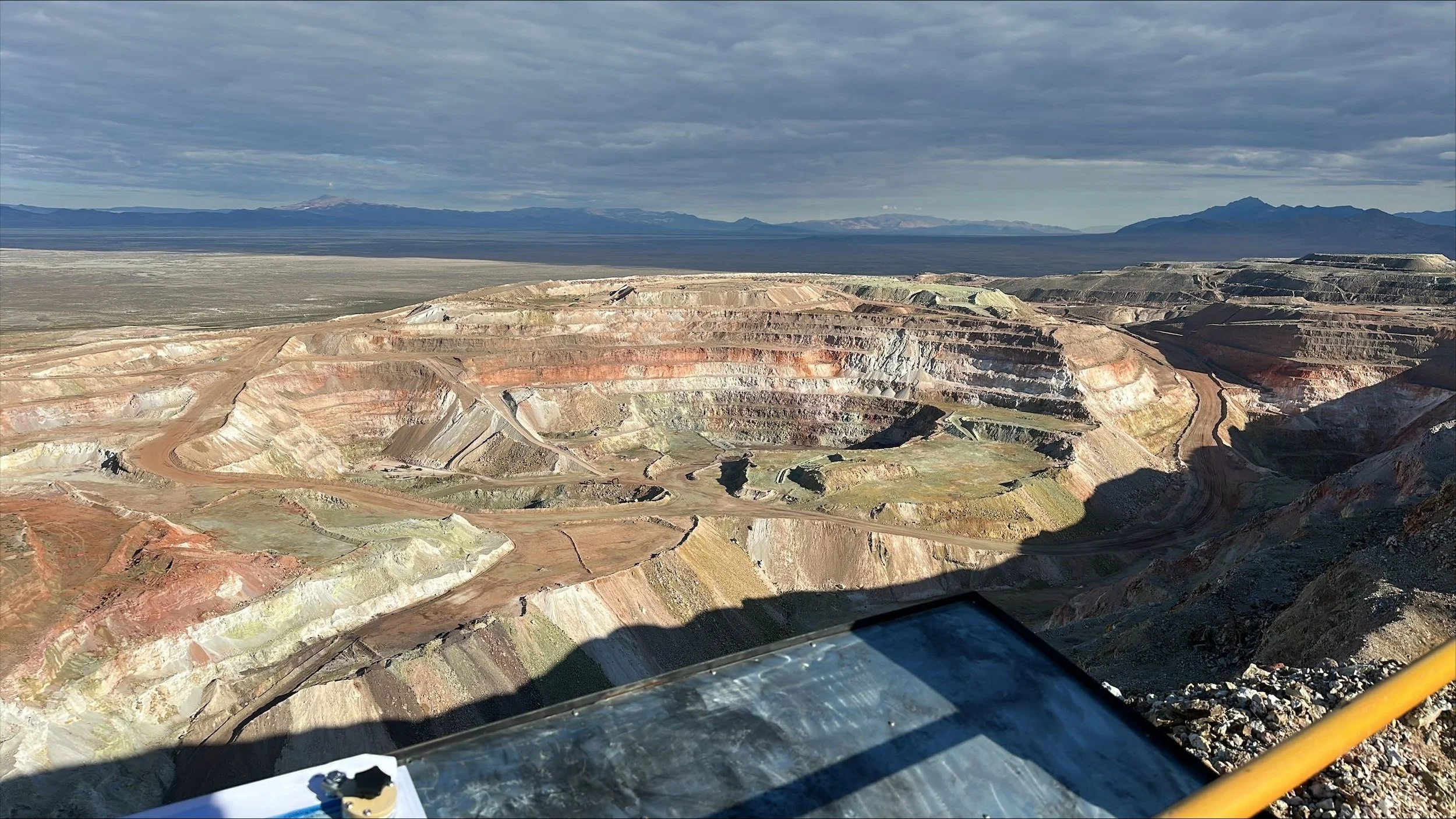

Enter Hycroft Mining

Today I’m replacing Silver Egg Coeur Mining with Hycroft Mining (HYMC) on the Nasdaq Exchange. With a market capitalisation of around US$350 million, Hycroft represents the largest undeveloped mainland American silver and gold project — holding roughly 15 million ounces of gold and 400 million ounces of silver in Nevada, the No. 1 US gold and top-three silver producing state after Alaska and Idaho.

Hycroft is run by Diane Garrett and her team, best known for their previous successful outing, Romarco Minerals, which was taken over by OceanaGold in October 2015 for C$856 million when the gold price was about $1,100 per ounce.

My contrarian instincts were titillated when, after recently giving my trustworthy Canadian broker a buying order for Hycroft shares, my broker called concerned I had lost my mind.

“Do you realise the history of Hycroft? The asset was a bust last cycle, it’s a refractory orebody and it’s a meme stock!!!”

Exactly. Hycroft is, in my opinion, the most misunderstood and underrated significant North American precious metal endowment.

Hycroft is to silver what MP Materials is to rare earths — the most important US domestic endowment of these critical minerals.

On the way home from the Precious Metals Beaver Creek Summit in Colorado, I detoured via Northern Nevada to visit the Hycroft Mine.

Hycroft History

The Hycroft Mine failed under previous owner Allied Nevada not because it was a “dud” but because it was a junior company without a balance sheet attempting to build a Tier One precious metal mine in a falling metal price environment.

Former Allied Nevada Chairman and Founder of Tier One North American gold producer Kinross Gold, Bob Buchan recently told Catt Calls:

“There is nothing technically wrong with Hycroft, it should be a 500,000 ounce per year gold plus silver mine. We [Allied Nevada] had too much debt in a falling gold price environment and management made some mistakes.”

Former Allied Nevada Chairman and Kinross Gold Founder, Bob Buchan

Hycroft Is Big

The Hycroft Mine at 3 miles long by 1 mile wide, is more like a giant base metal than a gold or silver mine. Hycroft has the scale and in-situ value of giant orebodies like Bingham Canyon (Rio Tinto 200,000 tpa copper mine), Penasquito (Newmont 500,000 ounce pa gold mine plus zinc), and Cordero (Discovery Silver future 20 million ounce pa silver plus zinc mine). Here are those orebodies resources and reserves where available:

Hycroft compared to other large mineral endowments

Hycroft Is Growing

The current 15 million ounce gold and 400 million ounce silver Hycroft resource should grow significantly with exploration, better metallurgical recovery and higher metal price (which make lower-grade ore economic).

Infrastructure and Permits

Hycroft has power, water and rail to its mining lease with current permits to mine and process gold and silver ore and will need additional permits to grow while considering process enhancements. Hycroft is well positioned to benefit from the designation of silver as ‘critical’ by the Trump Administration accelerating both permitting and funding potential.

Hycroft has a 50,000 tpd crusher already built

High-Grade History

The Rosebud gold mine on the 10-mile by 10-mile Hycroft Mining Lease was mined by Hecla and Newmont from 1997 to 2000 and extracted over 400,000 ounces of 12 gpt gold and over 2 million ounces of 2 ounce per tonne silver.

Hycroft drill rig aiming at high grade silver underneath the Brimstone pit

High-Grade Silver Exploration

Hycroft VP of Exploration Alex Davidson arrived from Nevada Gold Mines (a Newmont/Barrick JV) in 2022 to mastermind a breakthrough understanding of where to find the high grade silver at Hycroft. I visited a drill rig currently probing the “feeder system” underneath the Brimstone orebody.

Recent Brimstone high-grade silver exploperation results

Hycroft announced a drill intercept of 21 metres at 2,360 gpt silver plus gold in January 2025.

Quality Management

I was impressed with Hycroft management’s high standards that created success at Romarco with regard to regulatory engagement, safety, metallurgy and exploration.

What’s Next?

A new Hycroft Preliminary Economic Assessment (PEA) is due by Q1 2026 and will update new metallurgical work and process route options, with potential significant resource growth.

The Hycroft corporate balance sheet is under repair, led by multiple equity refinancings from Hycroft’s 33% shareholder and the world’s best-known silver investor, Eric Sprott.

Hycroft today has approximately US$130 million of unrestricted cash and $135 million of debt. The exercise of in-the-money existing warrants could put the company in a net cash position for the first time since Hycroft emerged from the bankruptcy of Allied Nevada in 2015.

Hycroft are working up new drill targets now aiming at the 200–500 metre deep high-grade silver in and around the Brimstone pit grading 500 gpt, with grades up to 10,000 gpt.

Today I’m adding Hycroft to my Silver Egg collection. If there’s one company that can become the lightning rod for US investor enthusiasm in Cinderella Silver - it’s Hycroft.

Have You Missed It?

After an impressive two years of precious metals bull market, I anm often part of conversations asking whether we are at the beginning, middle or end of this precious metal bull market.

I believe we are approaching the middle of the gold metal cycle but only the beginning of a bull market for miners. Gold funds have only been taking positive inflows for a few months this cycle. Newmont Mining, the world’s largest gold company, the first stop for generalist investors trades on a price-earnings ratio of 1/3 of its all time high in April 2022. In other words Newmont’s revenue line has doubled in three years and its share price is flat.

Newmont is trading on historically cheap price-to-earnings ratio

Recent gold fund and ETF inflows illustrate that investor psychology is changing from “taking profits” to “FOMO” (Fear of Missing Out) and “BTD” (Buy The Dip).

Echoes of the 1970s

The 1970s have many similarities to the current decade. Then US President Nixon ended gold convertibility with the US Dollar in 1971 at $35 per ounce, unleashing a decade of inflation and dollar debasement. Gold rallied 20 times to $850 per ounce by January 1980 following the Iranian revolution and the US freezing of Iranian central bank reserves.

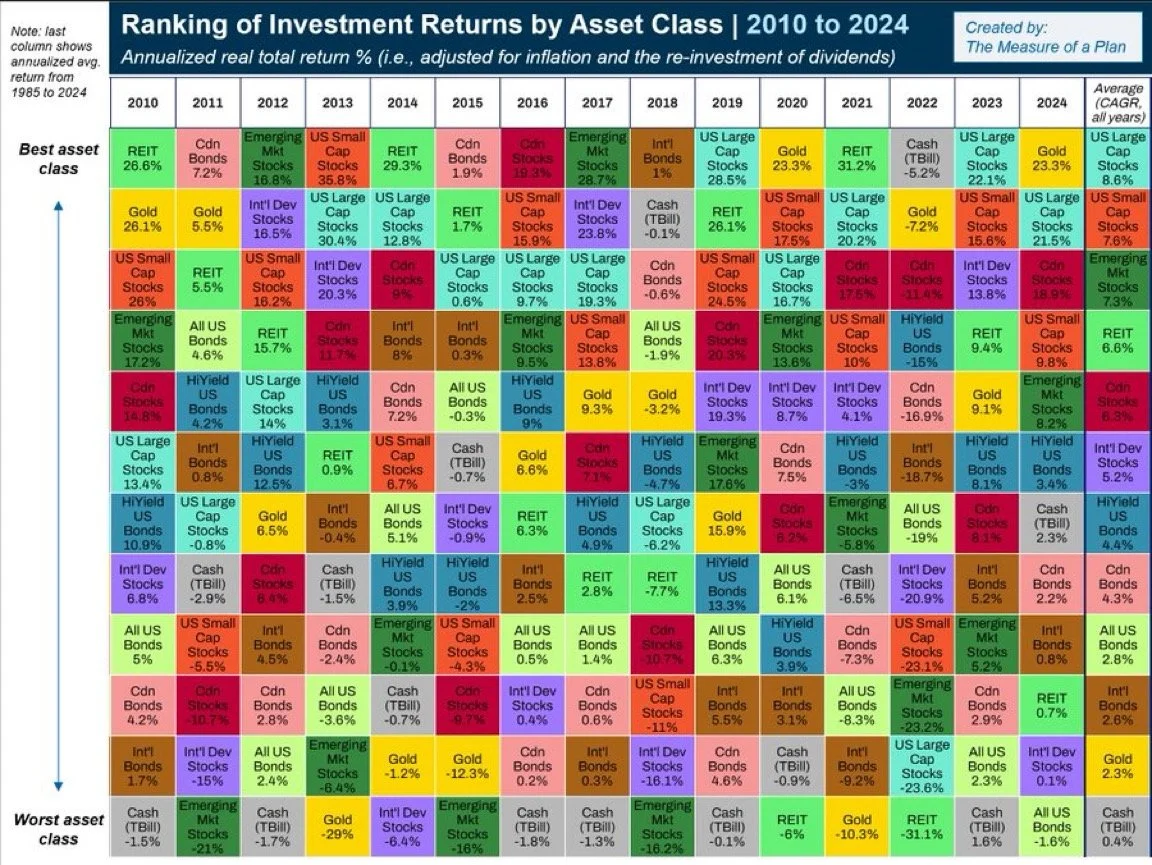

Gold was the top-performing asset class in six years in the 1970s and bottom for two, and has been top for three years of the 2020s to date.

Gold should enjoy a decade of good returns in the 2020’s, like the 1970’s.

Humanity knows that gold unlike fiat currency holds it purchasing power. Two millennia ago, in the time of the Roman emperor Augustus, Roman centurions were paid a salary equivalent to 38.58 ounces of gold. In 2025 this works out to an annual salary of ~$116,000, or roughly what a US Army Major makes.

Early Days

It is still early days in the great gold and silver bull market of the 2020s as American’s contemplate the monetary implications of Make America Great Again: higher inflation, lower interest rates and the subversion of the Federal Reserve to Trump’s will.

Conclusion: Cinderella’s Carriage awaits

The combination of record industrial and emergent investment demand means Cinderella Silver is ready to step into her carriage and make her glittering entrance.

Hycroft — with its vast endowment, critical US position and proven management — has the potential to become the lightning rod for American investor appetite for silver.

The music is about to start, Cinderella silver is on her way, the only question is will you be ready to dance?