Fitzroy Minerals: Big Copper Discovery In Chile

When you combine hard core exploration success with soaring commodity prices you get ten bagger potential. Add the most pro-business government in a generation in the world’s No 1 copper jurisdiction and you get why Toronto listed Fitzroy Minerals (FTZ:TSX) could be Ludicrous in 26

Chile The Home of Copper

Chile dominates global copper production because of tens of millions of years of metal deposition as an oceanic plate has pushed beneath South America, repeatedly generating copper-rich molten rock along a vast 7000km long mountain belt. This long, continuous process built an unmatched concentration of deposits in the Andes. Northern Chile’s extreme dryness preserved and enriched them instead of eroding them away, creating a rare alignment of geological scale, repetition, and preservation.

A Brief History Of Big Copper In Chile

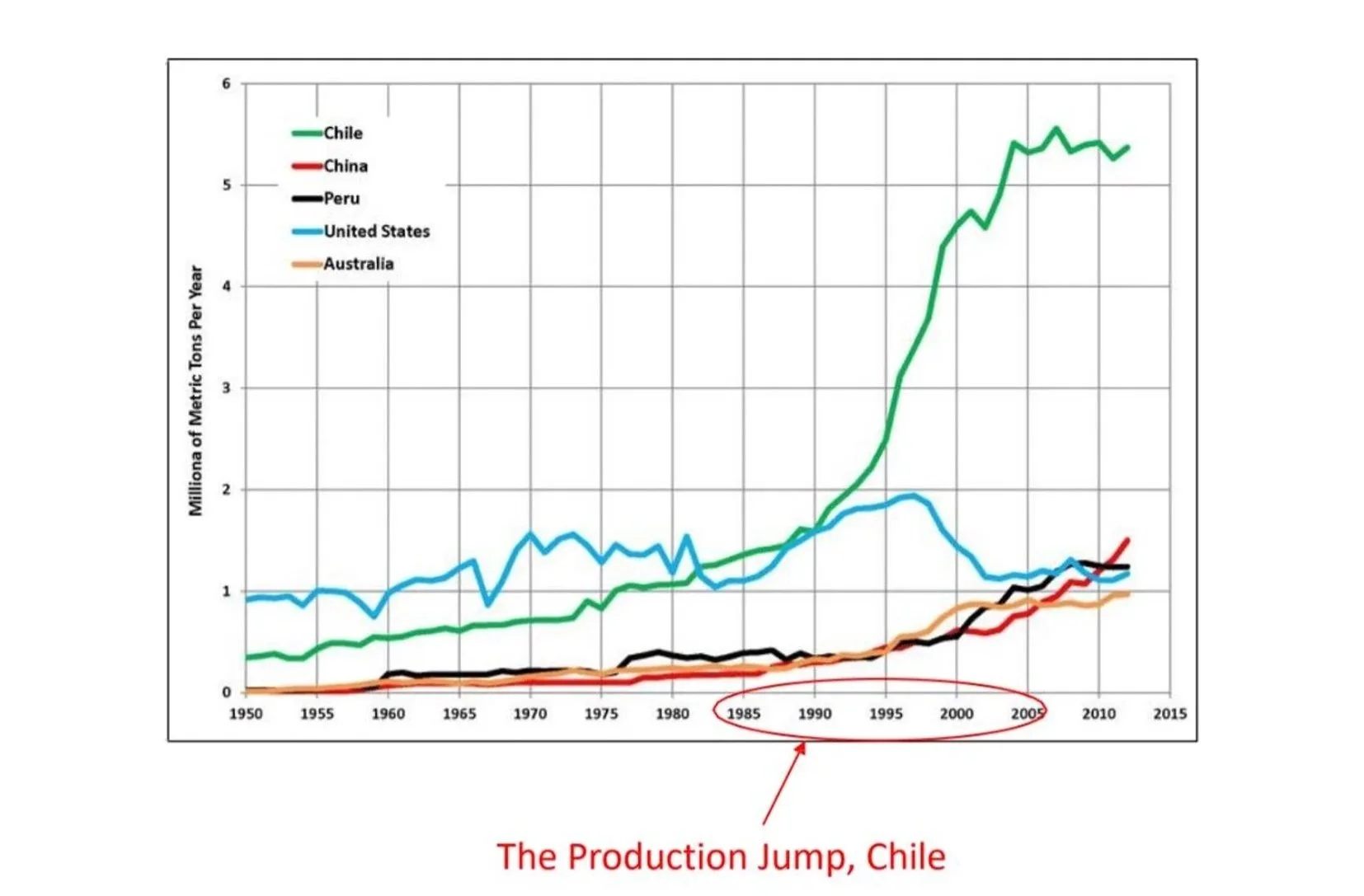

The 1980’s saw the implementation of a new Mining Code in Chile under the Pinochet regime which strengthened property rights, allowed foreign ownership of mines and guaranteed fiscal stability. The world’s biggest mining companies - BHP, Rio Tinto and Anglo American came and developed what are still today some of the worlds largest copper mines.

Chile reopened for business in the 1980’s

BHP’s Escondida Mine and Anglo American’s Collahuasi mines which were developed a generation ago in the 1980’s are today two of the world’s three largest copper mines but they are showing their age.

The port of Coloso south of Antofagasta in Chile is the gateway for Escondida copper exports

Escondida - the world’s largest copper mine - produced 1.345 million tonnes of copper in 2025 - about 6% of world output. BHP will invest $8 billion through 2030 to see Escondida production decline a third to about 1 million tonnes per year. This is part of a broader plan by BHP to invest US$10-14 billion in its aging Chilean mines as grade falls to sustain production.

The Worlds Most Important New Mine

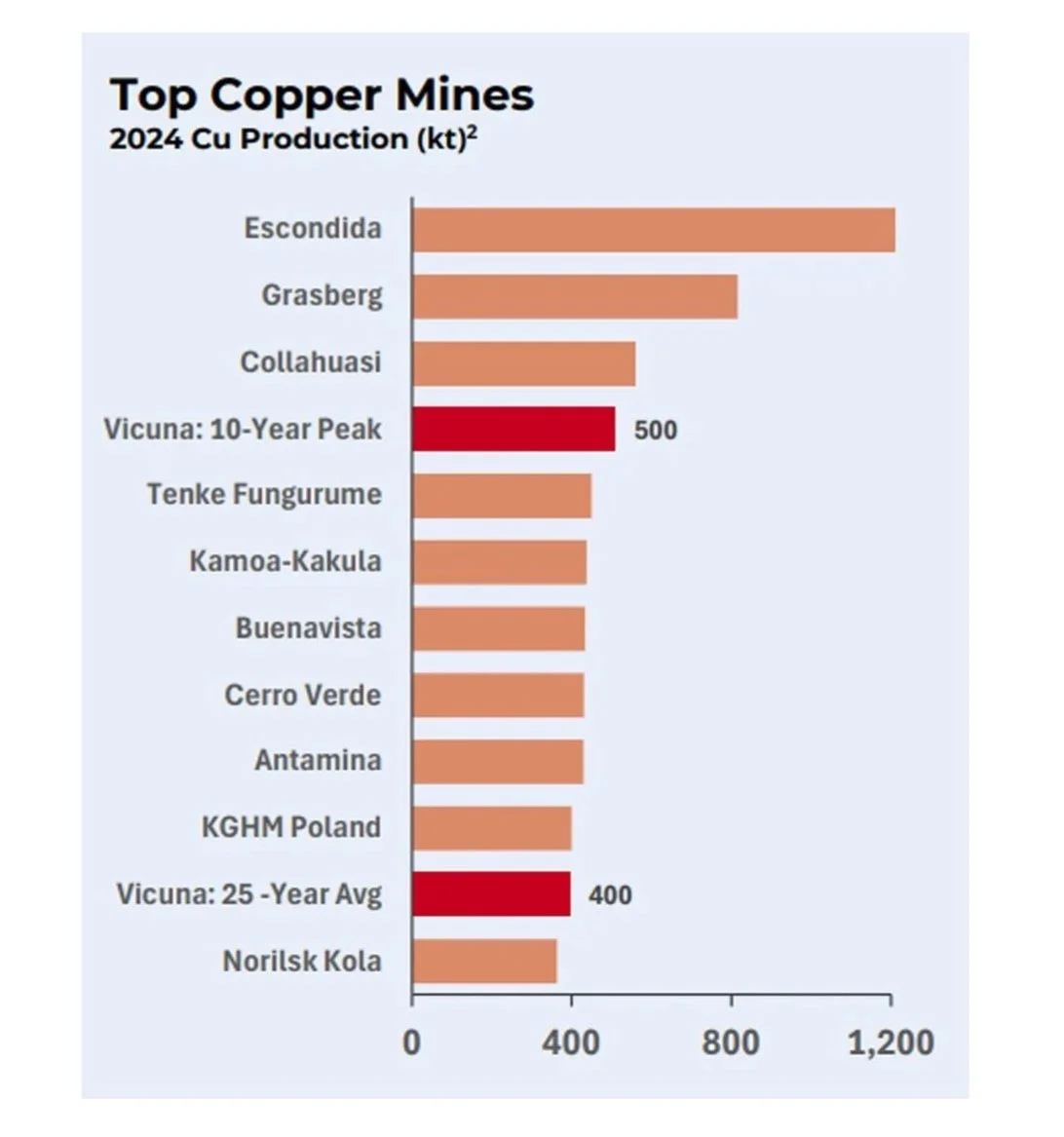

The recent election of the pro-business Javier Milei government in Argentina and the Jose Antonio Kast government in Chile have catalysed the go ahead for the world’s most important new mine: Vicuna which will be a top five global producer of copper, gold and silver. Vicuna, half owned by BHP and half by Lundin Mining will start production around 2030 with average annual production of 400,000 tpa of copper, 700,000 ounces of gold and 20 million ounces of silver. That’s a remarkable 700,000 tonnes per year of copper equivalent production for 70 years.

Chile hosts some of the worlds largest copper mines

Vicuna on the border of Chile and Argentina will get its desalinated water from a pipeline which runs 200km from the mines in the high Andes past Fitzroy Minerals sea level Buen Retiro project to a port on the Pacific Coast.

Vicuna the worlds most important new mine is Fitzroy’s near neighbour

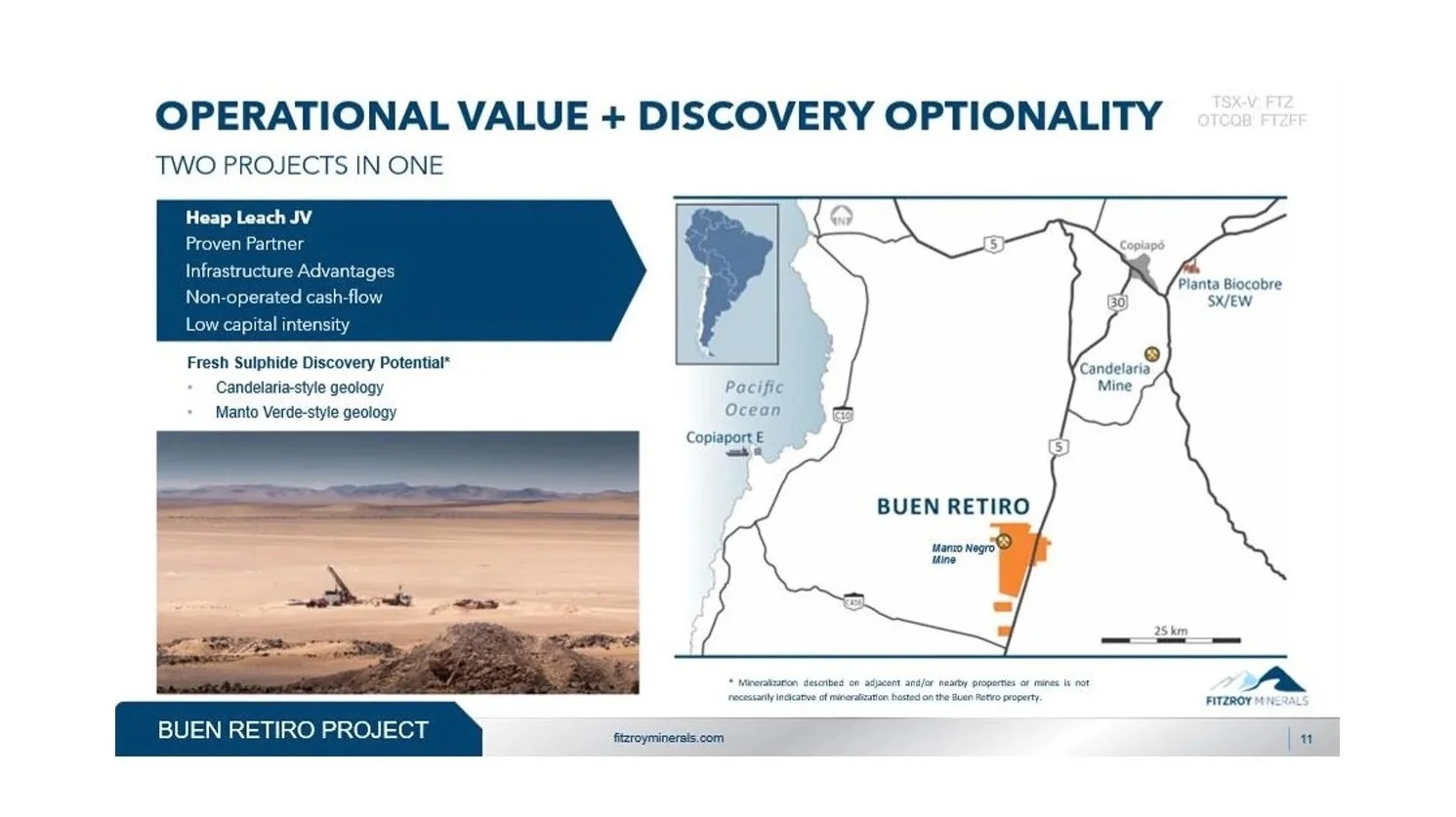

Lundin Mining’s Candelaria Mine is the most important mine in Copiapo, an important mining district in the Americas since the 1800s. Candelaria is a billion tonne Iron-Oxide-Copper-Gold (IOCG) mine that began production in 1995 and produces approximately 150,000 tpa of copper and 90,000 ounces of gold per year.

A Miners Paradise

Fitzroy Minerals Buen Retiro meaning ‘Pleasant Rest’ mine is 60km south of Copiapo and about 35km from the Pacific Coast from where it will export copper from the Copiaport E in the future.

The Buen Retiro area in Chile’s Atacama Region has been known for copper mineralisation for many decades, but systematic modern exploration only began in recent years. Historically, the Manto Negro copper oxide open pit, within what is now the broader Buen Retiro project area, was mined by Fitzroy’s Chilean partner, Pucobre Ltd in the 1990’s and trucked to Pucobre’s Planta Biocobre solvent-extraction and electrowinning facility near Copiapó for processing.

Fitzroy’s Buen Retiro mine has nearby processing capacity, port and water access

A perfect partnership

PuCobre is a medium sized Chilean copper miner worth ~ US$2.5 billion listed on the Santiago Stock Exchange producing ~ 40,000 tpa growing to 70,000 tpa of copper by 2027 as it commissions its new El Espino Mine in partnership with Denver based private equity group RCF.

Artisanal miners extracting valuable high grade copper ore from Buen Retiro in November 2025

Fitzroy consolidated ownership of the Buen Retiro district in 2023 and is surrounded by six hungry SXEW process plants including PuCobre’s Planta Biocobre plant 70km away.

When we visited the Planta Biocobre plant in November 2027 it was producing 3000 tpa of cathode copper with capacity of 10,000 tpa.

PuCobre’s Planta Biocobre can produce 10,000 tpa of cathode copper

Fitzroy management are working towards a mid 2027 investment decision on a 1.8 million ton per year copper oxide heap leach at Buen Retiro with a 7-8 year life for capital of US$40 million that could produce 14,000 tpa of copper by 2028.

Fitzroy CEO Merlin Marr-Johnson standing on top of the Buen Retiro copper mine

Near Term Cashflow

The remarkably low capital intensity of US$4000/ton of copper produced at Fitzroy’s Buen Retiro Project is possible because this is an existing mine surrounded by hungry Solvent Extraction (SXEW) plants bidding for Buen Retiro’s future copper concentrate production.

The Vicuna mine by comparison is forecast to cost US$18 billion of capital for 700,000 tpa of copper equivalent production from 2030 or ~ US$26,000 per ton of annual copper equivalent.

Fitzroy expect their Chilean partner Pucobre to buy 30% of Buen Retiro by paying Fitzroy 90% of its expenditure incurred before an investment decision expected in mid 2027 leaving Fitzroy 70% or approximately 10,000 tpa of attributable production with a margin of up to US$10,000 per tonne at current copper prices.

Hence Fitzroy shareholders can look forward to a low risk, capex-lite, brownfields restart of the Buen Retiro mine that could produce $100 million of attributable cashflow in 2028 for $40 million capex compared to a current value of C$150 million.

Although Fitzroy is therefore on an implied cashflow multiple of two times 2028 EBITDA that’s not the real reason I own Fitzroy shares.

This is Discovery in Real Time

Fitzroy have what every major copper major wants - two potential major copper discoveries:

A potential Candelaria twin at Buen Retiro - that is the sulphide IOCG orebody that sits underneath the weathered oxide Fitzroy is now preparing to mine

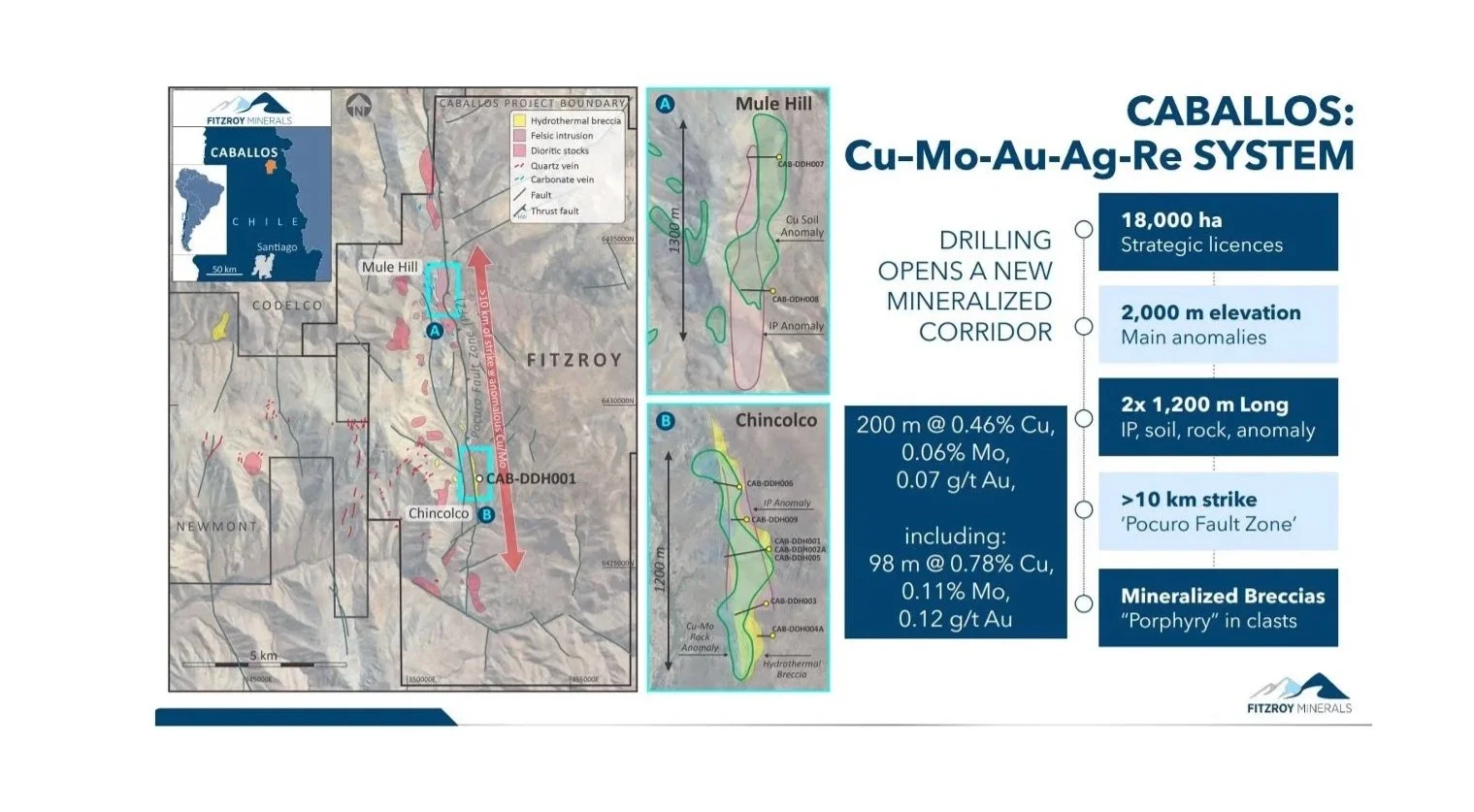

A potential porphyry copper discovery at its 100% owned Caballos Project in the low Andes near Santiago

Fitzroy drilling ahead at its Buen Retiro project near Lundin Mining’s Candelaria mine

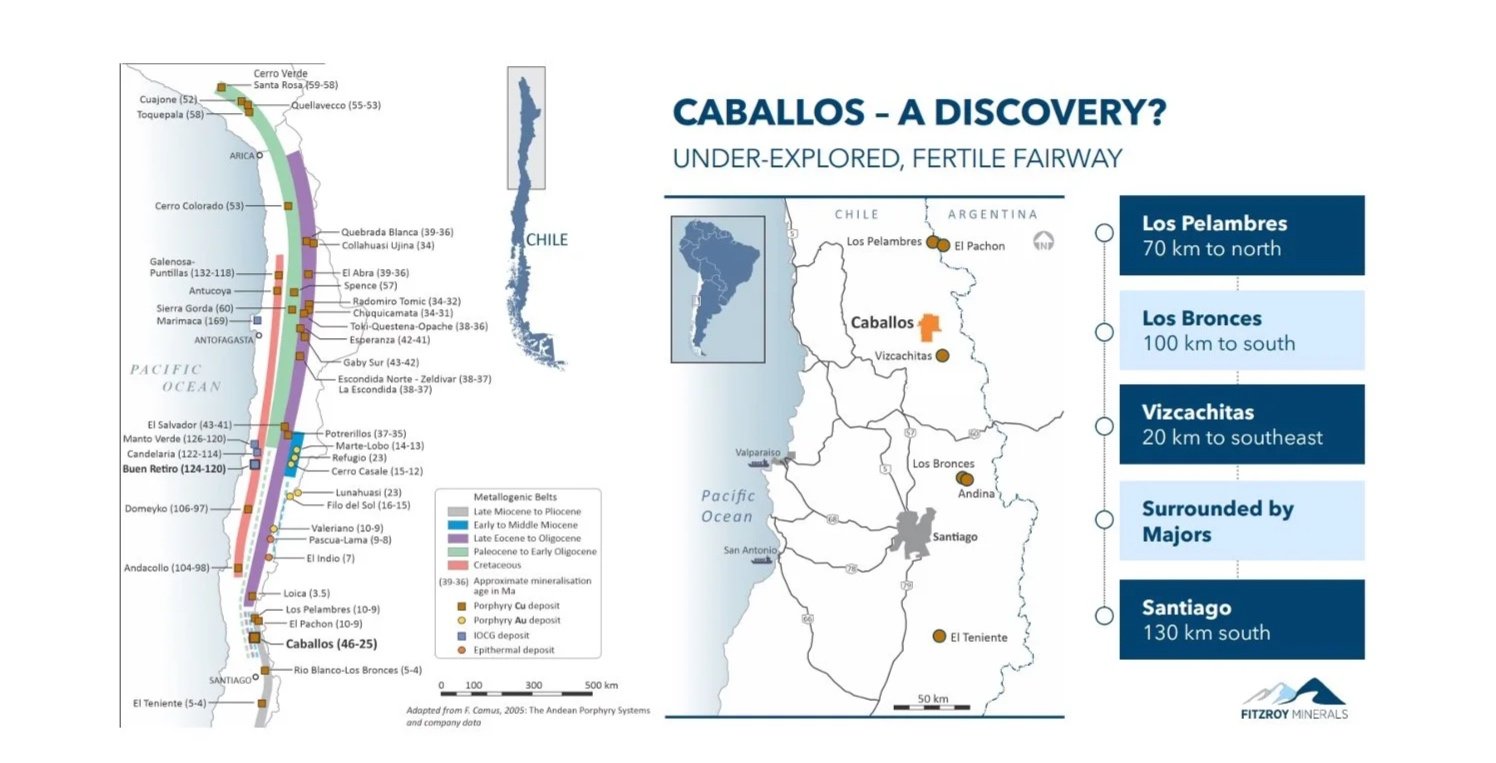

Unusually for a junior explorer developer Fitzroy has not one but two significant emerging discoveries. Its 100% owned Caballos Project sandwiched in between 80 million tonnes of contained copper at Antofagasta’s Los Pelambres and Anglo American’s Los Bronces projects was formerly owned by mining major Vale. Fitzroy’s country manager Gilberto Schubert who has lived 30 years in Chile was previously Vale’s country manager.

Fitzroy’s Caballos project is ‘mid-discovery’

In March 2025 Fitzroy drilled a discovery hole into Caballos of 200 metres at 0.46% copper plus molybdenum and gold credits that totalled 0.8% copper equivalent.

Caballos has significant by product credits that could mean negative copper production costs

A Ten Bagger?

The coincidence of high impact discovery, rising copper prices and the best political and regulatory environment in a generation in Chile is why Fitzroy Minerals is a possible ten bagger.

The drill bit will drive the Fitzroy share price for the next two years before it contemplates low-risk and low-cost copper production with a capable partner in a brownfields mine restart.

Watch my conversation with Merlin Mar-Johnson here 👇