Ludicrous in 2026?

Michael Saylor and our Christmas hamster both had a tough 2025.

Lets take a quick recap of Cattcalls Big Calls for 2025 and offer up three ten bagger ideas for 2026 in search of LUDICROUS investment performance.

I am sad to report the 2024 Christmas miracle at the Catt household — our Russian Dwarf Hamster — topped himself. It turned out our Rusky rat was a free spirit so after a fabulous fresh air frolic in the Italian summer sunshine the little fella went on a hunger strike after being returned to his darkened cage. Our 8-year-old was unconsolable until we found a replacement while our 6-year-old seemed not to mind at all.

If you held Saylor’s bitcoin holdco ‘Strategy’ from last Christmas to this Christmas you lost half your money as it devalued from two times the value of its bitcoin to less than one while bitcoin itself fell 11% from $99,000 to $88,000 in a year.

→ Old money worked best in 2025 and maybe 2026 too.

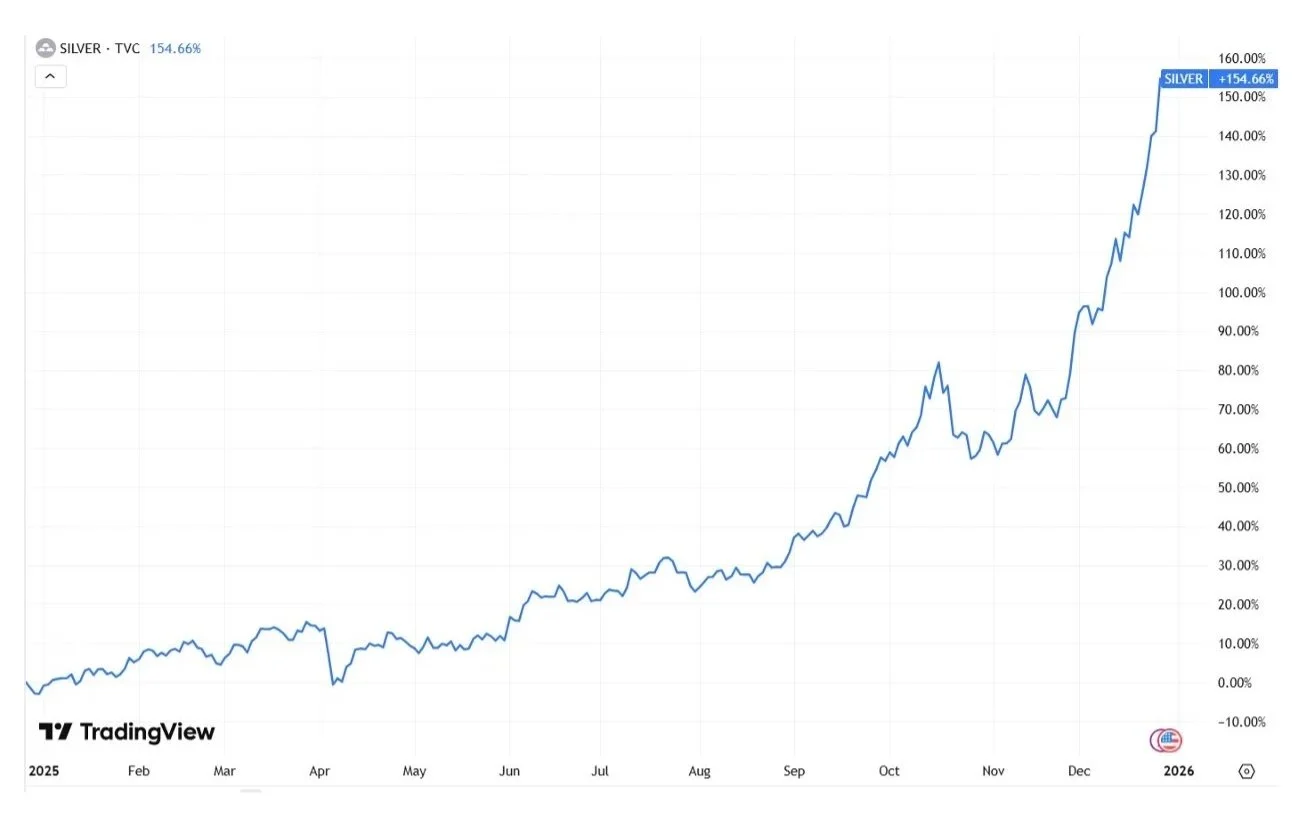

Catt Calls’ once outlandish October 2024 silver $100 per ounce prediction is coming into view. We like Michael Oliver’s $200 per ounce call for the first half of 2026!

Silver is closing in on $100 per ounce

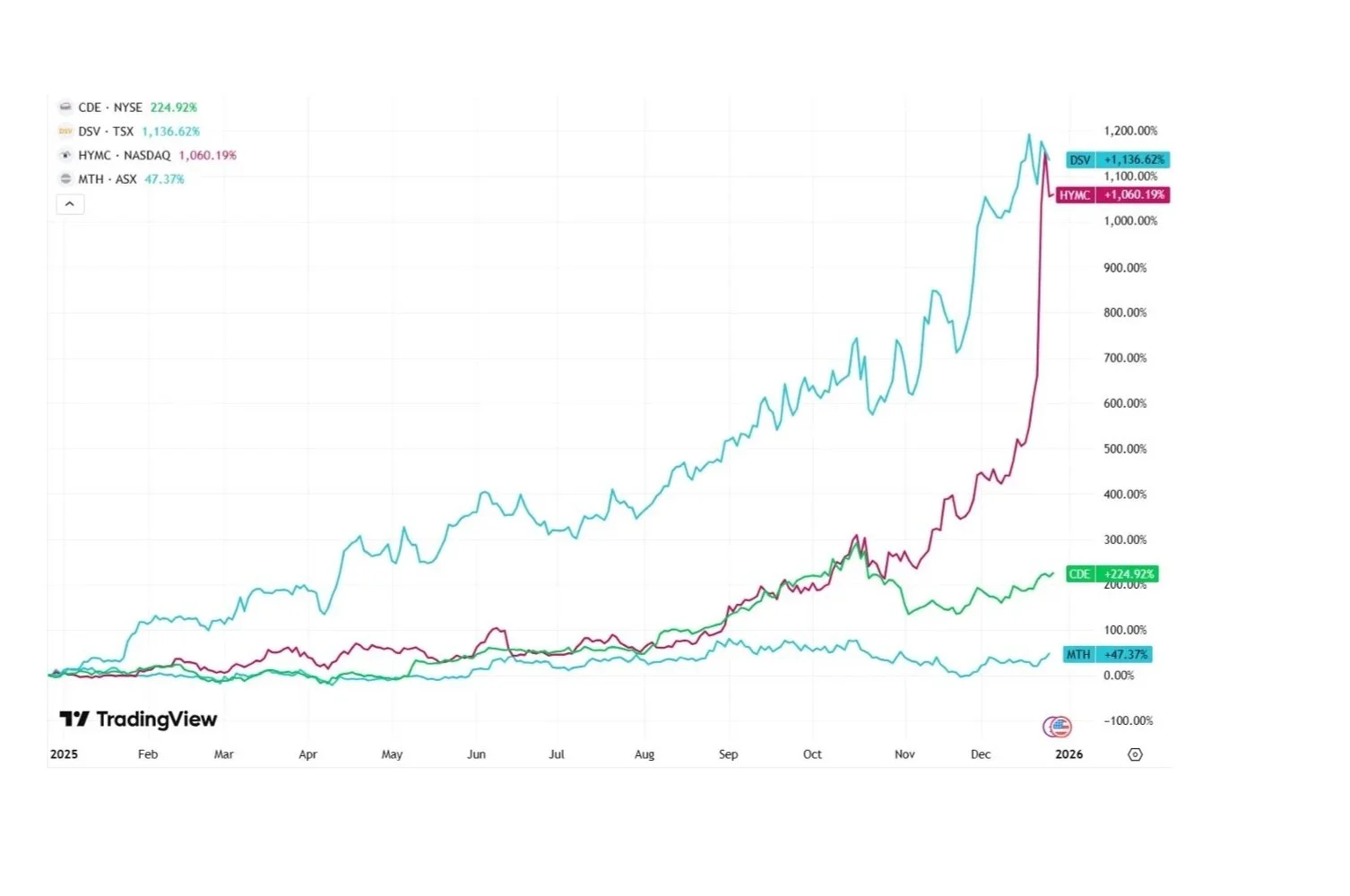

Discovery Silver (DSV:TSX) rallied 1000% — or 10 times — in 2026 after it bought the Porcupine tier-one gold camp in Canada from Newmont for cents in the dollar, proving the time-honoured strategy of buying assets from major mining companies.

→ Stay with me. This is where capital rotation starts to matter.

I think DSV can double again in 2026, which would make it a 20-bagger from inception. I recently spoke to Discovery Silver CEO Tony Makuch in London:

In search of LUDICROUS performance, I swapped the Coeur Mining Silver Egg for Hycroft Mining in September 2025 — so far, so good.

I am sticking with the remaining and third silver egg - Mithril Silver & Gold (MTH:ASX) which rallied a modest 47% in 2025 and is accelerating its search for high grade silver and gold from January 26 - a good sign - and adding a third drill rig.

Cattcalls three silver eggs remain: Discovery Silver (DSV:TSX), Hycroft Mining (HYMC:US) and Mithril Silver & Gold (MTH:ASX).

Ten Bags or Bust

→ This section cost me money. It might save you some.

Nothing in this business delivers fabulous wealth and euphoria like exploration success. How do you recognise a ten-bagger opportunity — and (mostly) avoid the busts?

This essay is the product of painful losses, lost opportunities and a few winners. As my now 20-year-old son Oliver says: “Don’t trust Dad — do your own work.”

When Oliver was 11 years old I granted him his wish to test drive a Tesla with me. We were regular visitors to the Tesla (now BYD!!) showroom at the Westfield shopping centre in west London.

Oliver has his own share portfolio and once he had experienced the ‘Ludicrous’ acceleration of the Tesla Model S he wanted to buy Tesla shares, then trading around $15 a share in 2016.

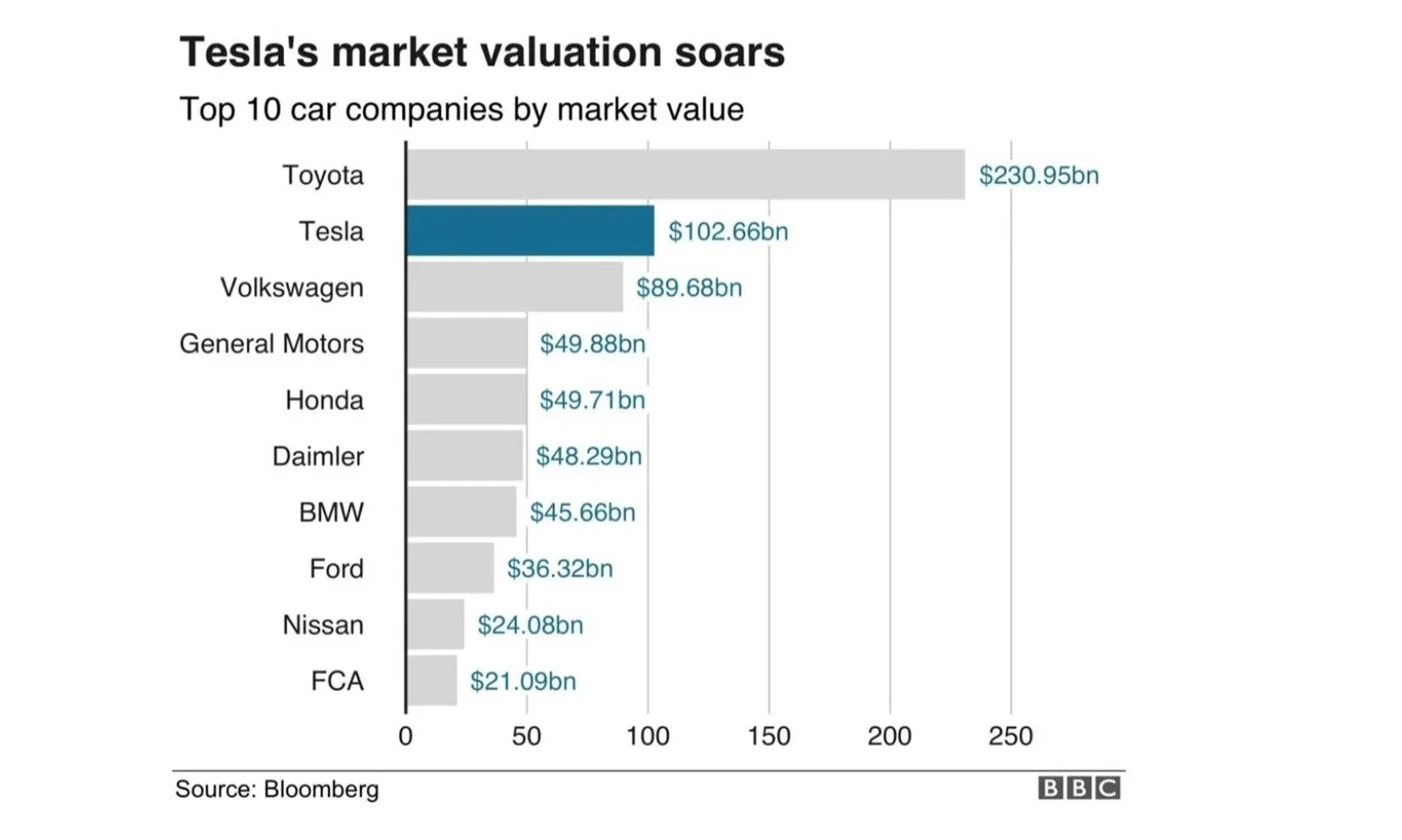

Thinking I was protecting my lad from a portfolio performance crash I talked Oliver into buying Volkswagen — which had recently suffered ‘Dieselgate’ — instead of Tesla.

If my lad had followed his own 11-year-old instincts versus his dad’s advice he would have made over 30 times his money. Tesla trades today around $480 per share.

Tesla overtook Volkswagen’s market capitalisation in 2020.

Listen to Oliver. Do your own work. Hone your instincts by making lots of mistakes.

If you aspire to be Warren Buffett, read no further. This is Cattcalls — and we are looking for LUDICROUS investment performance.

→ If you only skim one part of this piece, don’t skim what comes next.

Below we lay out how ten-baggers are actually made — and why most never get there.

Potential Ten Baggers For 2026.

1️⃣ Hycroft Mining — The Silver Cinderella That’s Still Dancing

Three months ago on September 21st 2025 I wrote:

“ If there’s one company that can become the lightning rod for US investor enthusiasm in Cinderella Silver - it’s Hycroft.” (mAGa Dollar: Silver Cinderella)

Then Hycroft Mining (HYMC:US) was capitalised at US$350 Million at US$7.00 per share.

Today Hycroft is worth over US$2 billion at ~ US$25 per share. (Even a blind squirrel finds a nut occasionally.)

It’s not over yet.

Hycroft is today about half the market capitalisation it was in 2012 when gold and silver prices were less than half current levels and the former owner of Hycroft - Allied Nevada - was capitalised at over $4 billion.

Because Hycroft was then a low grade 0.4gpt gold project the more than doubling of the gold price makes Hycroft’s ~ 15 million ounces of gold and future production multiply in value more than the increase in the gold price. That’s because you get greater operating margin expansion from a low-grade-high-cost project than a low cost project.

Now observe the latest drill results from Hycroft’s ‘Vortex’ orebody grading 400-500gpt silver are over 20 times the current Hycroft silver resource grade of ~15gpt silver.

To derive the value of Hycroft add the new high grade silver discovery to the existing gold resource.

I believe Hycroft is in the process of discovering a 200–300 million ounce silver project at grades of 300–400 grams per tonne, with the potential to produce 10–20 million ounces of low-cost, high-margin silver annually.

Hecla Mining which produced 140,000 ounces of gold and 16 million ounces of silver in 2024 is capitalised today at over US$13 billion.

Here is some Silver-Spastic chat with the Silver GOAT Mr Eric Sprott, yours truly and Hycroft CEO Diane Garrett

Grab some popcorn, a pair of binoculars and look up, we’re heading to The Moon kiddo.

2️⃣ Advance Metals - Two Shots on Goal: Aussie Gold, Mexican Silver

Advance Metals (A$0.14 A$50 million market cap) is drilling ahead at its Happy Valley high grade gold project in Victoria, Australia with grades averaging half an ounce of gold and up to 160 gram (over 4 ounces of gold) per ton over 11 metres from 190 metres depth. Advance recently doubled the drill rigs at Happy Valley and we expect an acceleration in the drill program in 2026 as the pace of discovery at Happy Valley accelerates.

I interviewed Advance Metals Managing Director Adam McKinnon recently to ask him about what the recent drilling at Happy Valley meant:

Advance is also exploring for silver in Mexico with an existing inventory of over 100 million ounces of silver equivalent. We expect news in January from Advance’s Yoquivo Project in Mexico which has a resource grade averaging over 500gpt silver.

Advance shareholders get two for the price of one and we expect both the Aussie gold and Mexican silver exploration results to reward Advance Metals shareholders in 2026.

3️⃣ Fitzroy Minerals — Hunting Copper Giants in the World’s Best Zip Code

Fitzroy Minerals (FTZ C$110 million mkt cap) are hunting copper giants in the world’s best endowed copper jurisdiction - Chile.

Fitzroy has two copper discoveries unfolding LIVE - ‘Buen Retiro’ is near Lundin Mining’s Candelaria +300,000 tpa copper mine and ‘Caballos’ bordered by the giant Los Pelambres and Los Bronces copper mines run by Antofagasta and Anglo American.

In 2026 we expect Fitzroy to describe Buen Retiro’s potential 2028 low risk, low capex copper mine with its local partner the $1.5 billion PuCobre which has spare SXEW capacity bidding for copper.

Meanwhile Fitzroy is also following up serious exploration results of over 100 metres at over 1.5% copper equivalent including molybdenum, gold and rhenium over 5 kilometres of strike.

In search of a TRULY LUDICROUS multi-bagger I travelled to Chile in November with Fitzroy management, here is CEO Merlin Marr-Johnson and Country Manager Gilberto Schubert talking about a their discovery in process at Buen Retiro project near Lundin Mining’s Candelaria copper and gold mine:

This Is What Optionality Looks Like

Hycroft Mining, Advance Metals and Fitzroy Minerals are all potential ten baggers from current share prices. As gold, silver and copper continue to make new all-time highs into 2026, I believe rising commodity prices will act as a powerful amplifier for real discovery - separating signal from noise. I am a shareholder of all these fabulous companies and strapped in for the ride.