Hycroft: Moonshot

Is it too late to invest to invest in gold and silver, or gold and silver miners? What if I told you a ten bagger in 2025 could rally a further ten times in 2026 - a 100 bagger!?

I can’t see the future but I am here to tell you I have spent all of my adult life as a student of capital markets and investing in mining companies, learning expensive lessons. This is about a Moonshot:

Hycroft Mining Corporation ticker HYMC on Nasdaq is a Moonshot.

Precious bulls are misfits

Gold is almost US$5000 an ounce and silver is $100 an ounce. If you are invested in gold or silver or miners you are a ‘Misfit’. How many of your friends own precious metals or invest in miners. Unless you are Chinese the chances are you and most people you know have more wealth in bitcoin aka digital gold than gold or silver.

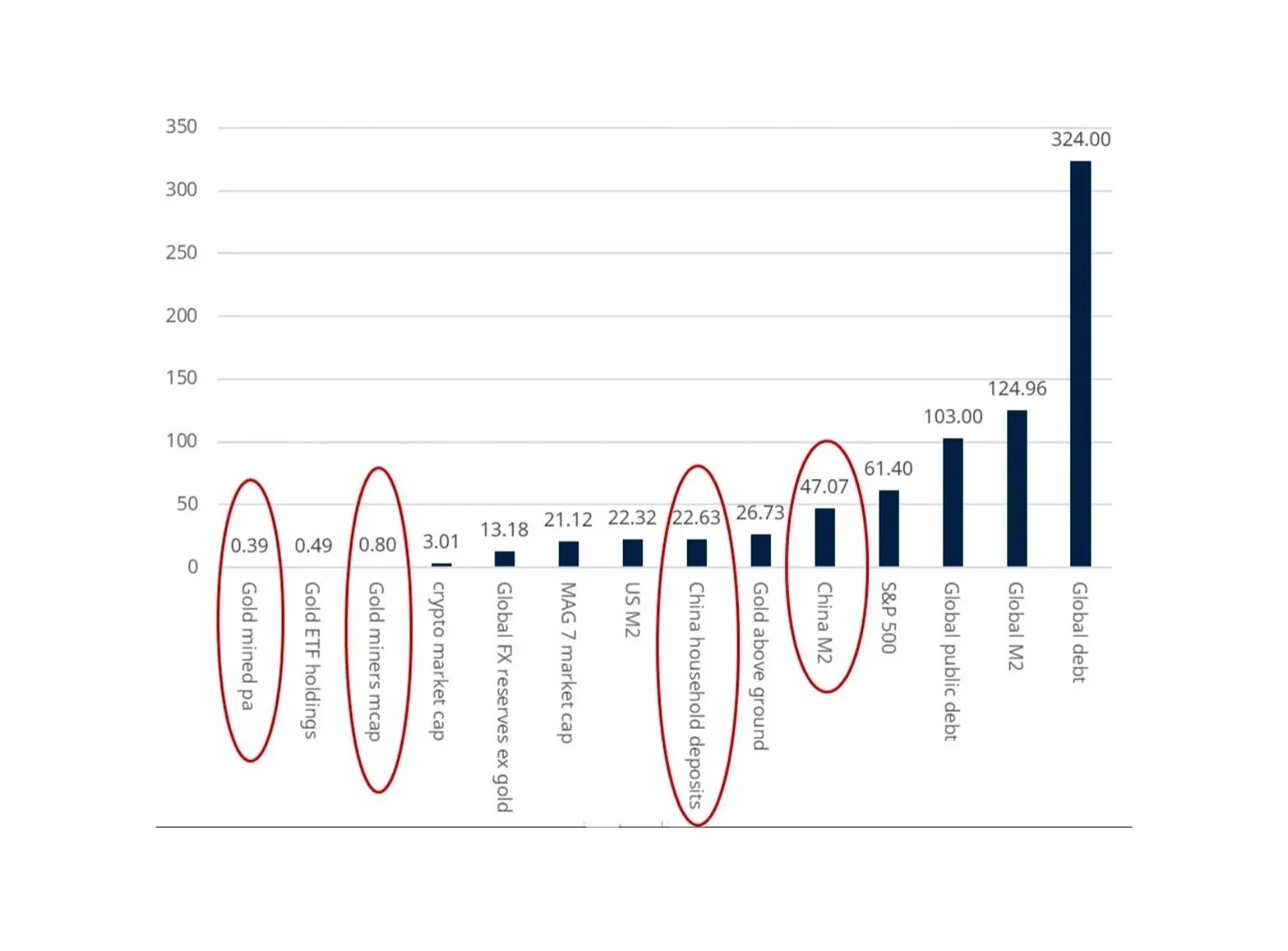

There is over twice as much money invested in Crypto as gold ETF’s and gold miners

Despite record inflows to Exchange Traded Funds (ETF’s) in 2025 gold ETF’s are still only one third of last cycles highs as a proportion of all global ETF assets.

Newmont Mining (NEM:US) as a proxy for the gold and silver miners is up ~ 300% in 2025 but is still ‘cheap’ with a Price Earnings (PE) ratio of 18 times versus the S+P 500 on a PE ratio of about 30 times.

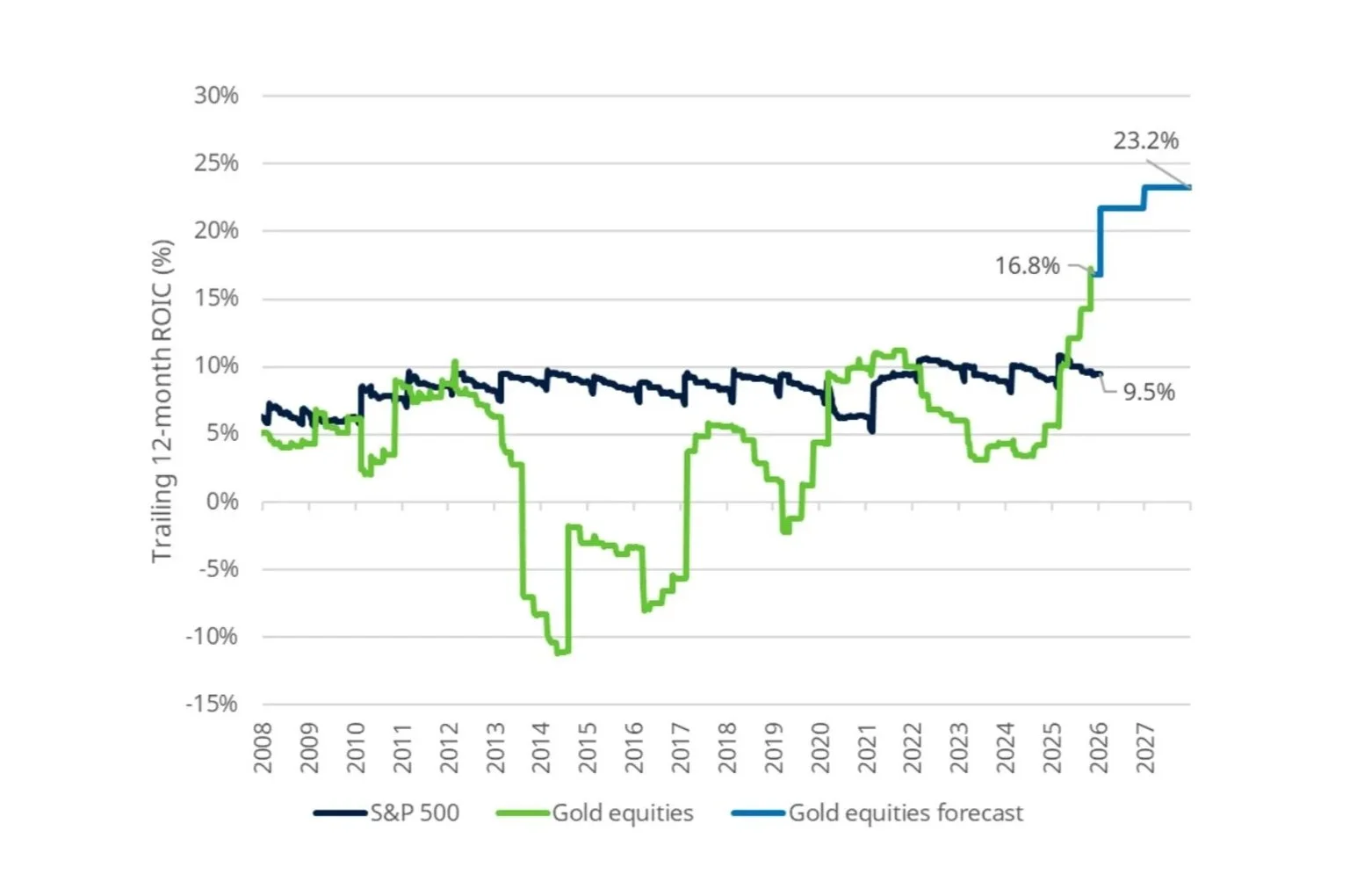

Gold mining is outrageously profitable. The average gold company earns a 23% Return on Invested Capital (ROIC) versus the average 9% return for all the companies in the S+P 500 Index of North America’s largest companies.

Thanks to London based ace stock picker Jim Luke who runs the Schroders Gold Fund for these charts.

Gold and silver prices today of ~ $5000/oz and $100/oz are 45% and 157% higher than 2025 gold prices of $3435/oz and $40/oz. The implication is that unless metal prices pull back sharply the gold and silver miners need to rerate sharply higher - stratospheric earnings will be the catalyst for the rerating.

Diamond Hands

It’s emotionally hard to hold - to have ‘Diamond Hands’ or to buy after a stock goes up 1,000%, self-doubt and the urge to “be sensible” conspire to pry shares from weak hands. This is where most fortunes quietly die.

Hycroft Mining Company (HYMC on Nasdaq) has rallied 1000% in 2025 and 2026 could be even better:

Lets acknowledge that the entry price into any investment is important for your ultimate return.

What most people - me included - do when looking at a new or existing investment idea is to look at the share price chart and decide whether you are early or late. This can be costly.

In July 2004 when I was working in the Haywood Vancouver office legendary investor Bob Disbrow threw me a Paladin Energy research report and said “Simon you should buy some of these”. I asked Bob what price he was personally long Paladin: ‘ten cents’ said Bob. Paladin was then trading at 15 cents and moved to 20 cents while I thought about investing.

I decided I had missed Paladin and watched it go to A$10 per share. Bob and most of the Haywood office made a 100 bagger on their investment as the uranium price rocketed to $150 per pound in 2007. A $10,000 investment at AUD 10 cents in Paladin in 2004 became A$1 million.

I missed a potential 50 bagger because I was evaluating an investment based on what someone else had paid. An expensive lesson and not my last for sure!

Once you have ‘found’ a potential ‘Moonshot’, when should you sell?

Firstly a quick refresh Hycroft history:

The Hycroft district in Nevada was mined for sulphur in the late 1800’s then high grade silver in the early part of the 20th century.

The early 1980’s saw various owners of the Hycroft property until Vista Gold consolidated control of the Hycroft, Lewis and Crowfoot mines in the late 1980’s through 2005 into what we know today as the Hycroft Mining Company.

Between 1983 to 1998 Hycroft produced 1.2 million ounces of gold and 2.5 million ounces of silver.

In May 2007 Vista Gold spun out its Nevada gold assets as “Allied Nevada” which steadily expanded production and processing capacity at Hycroft with stated plans to produce 500,000 ounces of gold per year installing one of North America’s largest processing plants.

The Hycroft crusher is a monster at 58,000 tons per day or 21 million tons per year

Allied Nevada was capitalised at over US$4 billion in 2012-13 when gold was about one third of current prices before going broke in 2015.

Former Allied Nevada Chairman and Founder of Tier One North American gold producer Kinross Gold, Bob Buchan explained to me recently why Hycroft went broke:

“There is nothing technically wrong with Hycroft, it should be a 500,000 ounce per year gold plus silver mine. We [Allied Nevada] had too much debt in a falling gold price environment and management made some mistakes.” (Maga Dollar)

In 2020 Diane Garrett and her team took over at Hycroft. Diane made investors good money selling her former company Romarco to Oceana Gold for over C$800 million.

The Garrett-led Hycroft has spent five years repairing relationships with stakeholders, bringing new thinking, credibility and capital.

Only on October 16th 2025 did Hycroft finally get the debt monkey - a legacy of the Allied Nevada bankruptcy ten years earlier - off its back. Today after several refinancings Hycroft has over US$200 million of cash and no debt. For the first time ever Hycroft can aggressively expand their exploration program at what is already North America’s largest undeveloped silver and second largest gold project.

Late in 2025 Hycroft announced important new high grade silver exploration results from its “Vortex” orebody as the silver price made new all time highs.

Hycroft’s exploration results demonstrate increasing grade and continuity. The latest drill holes in the Vortex and Brimstone orebodies at Hycroft are grading 10-16 ounces silver per ton or over ten times the average value per ton for Hycroft’s existing 1.5 billion ounce silver equivalent resource.

New geophysical technologies combined with a fresh approach from new management unconstrained by budget and a mandate for growth are delivering Hycroft’s best ever exploration results.

The old adage that the best place to find a new mine is next to an old one appears totally true for Hycroft! Exploration success today is consistent with Hycroft’s high grade past.

Brownfields discoveries that benefit from existing infrastructure - and Hycroft has permits, power, water and even a railway line - enable mining and cashflow years quicker and for much less capital than greenfield discoveries.

I recently joined an X Space conversation with Hycroft CEO Diane Garrett about what the latest drill holes from Vortex might mean for Hycroft:

Metal Mania - Valuations Past & Present

Silver miners and developers are usually more expensive than their gold brothers because silver outperforms gold in bull markets and there are less investable silver companies. Hecla and Coeur Mining - the oldest US silver companies - for example trade around 30 times their earnings versus Newmont around 18 times.

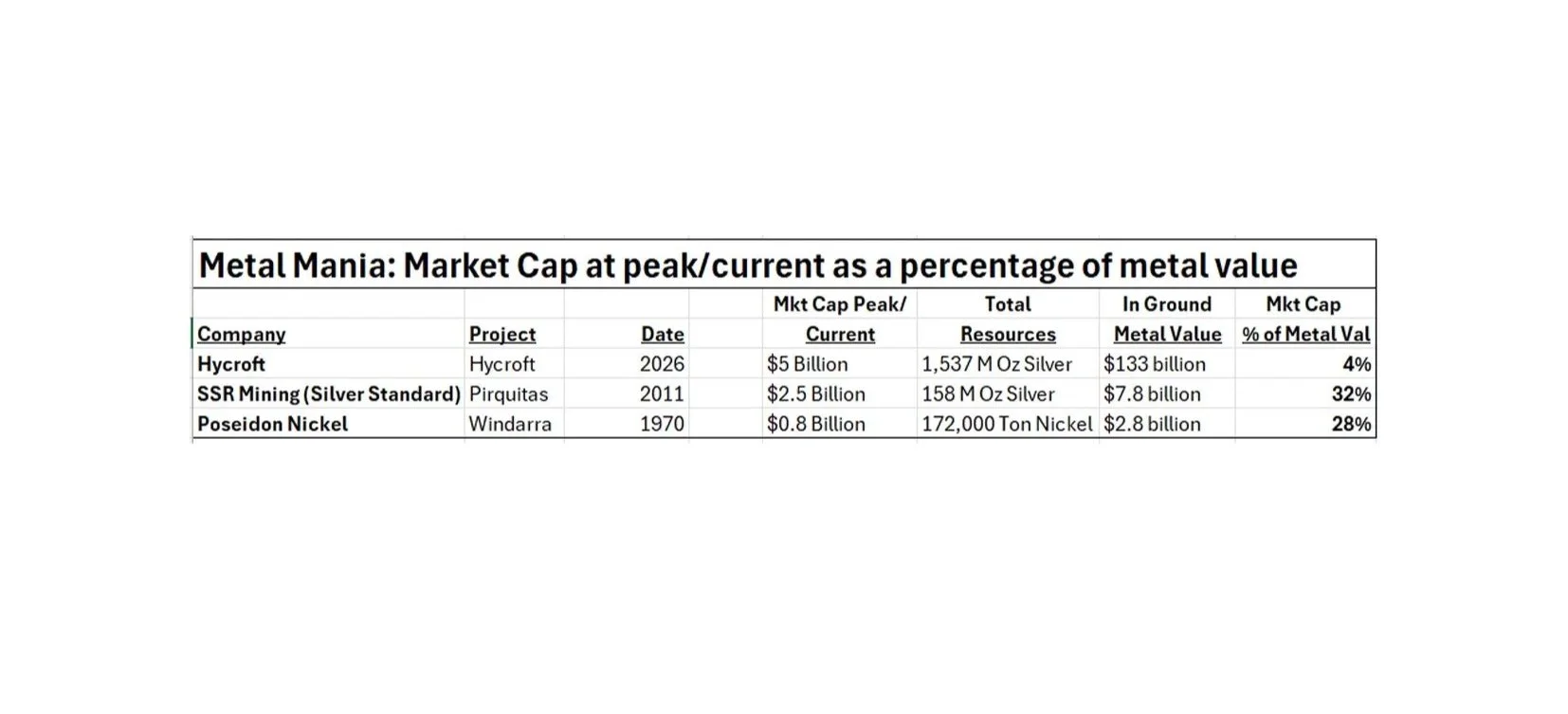

A mining companies market capitalisation can be compared to the value of its metal in the ground. Hycroft is trading at only 4% of its in ground metal value versus peak metal value of 30% in previous metal manias like Poseidon Nickel in 1970 or Silver Standard in 2011.

The comparison with Poseidon in 1970 and Silver Standard in 2011 implies Hycroft can rally 7-8 times from today’s US$50 share price to ~ US$300-400 per share using today’s silver and gold prices.

Note that the above gold and silver resources are now three years old and we expect Hycroft to update and increase its resources significantly this quarter with recent drilling success and increasing metal prices.

Location matters

Hycroft is located in Nevada the No 1 US state for mining which produces ~ 70% of all US gold and about 20% of its silver. Within 200 miles of Hycroft are the most valuable gold mines in the United States: Barrick and Newmont’s Nevada Gold Mines Joint Venture Mines, SSR Mining, Hecla and Couer are all in Nevada.

Being surrounded by mining infrastructure, expert labour and knowledgeable regulators de-risks and accelerates mine development in Nevada.

Hycroft is a strategic asset

Silver - the best electrical conductor - is regarded as a critical mineral by the United States government for its uses in electronics, defence and war.

If there is one silver project in the United States that deserves support from a US government intent on reviving its mining industry as the foundation of supply chain resilience - it’s Hycroft because:

Hycroft is the largest undeveloped US silver project at over 400 million ounces plus 15 million ounces of gold

Hycroft was originally mined for sulphur and the adjacent Lithium America’s Thacker Pass project needs sulphuric acid to process it lithium. Hycroft - which was originally a sulphur mine - is the logical source of sulphuric acid as a by product of mining silver and gold.

Its time to be a pig

Famed investor Stanley Druckenmiller said the best opportunities come when narrative, momentum, and liquidity are all aligned.

“That’s when you press. That’s when you can afford to be a pig. “

“When you see something that you’re confident in, you want to bet big. You don’t make money by nibbling.”

Buckle up space cowboy - the Hycroft Moonshot will include wild corrections that will leave you feeling disoriented and nauseous. Landing on the Moon will be worth the ride.

Disclaimer: This is not investment advice. It reflects my personal views at the time of writing and is intended for general information only. Do your own research. I am a shareholder of Hycroft Mining.